nj payroll tax calculator 2020

Payroll Tax Salary Paycheck Calculator New Jersey Paycheck Calculator Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

2022 Federal Payroll Tax Rates Abacus Payroll

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. 1 2018 that rate decreased from 6875 to 6625. New Jersey Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

Your average tax rate is 1198 and your marginal tax. Any wages earned above 147000 are exempt. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

The flat sales tax rate means you will pay the same rate. Nj Employer Payroll Tax Calculator. Employer Requirement to Notify Employees of Earned Income Tax Credit.

Discover ADP Payroll Benefits Insurance Time Talent HR More. After a few seconds you will be provided with a full breakdown. Fill out for any.

Supports hourly salary income and multiple pay frequencies. Ad Process Payroll Faster Easier With ADP Payroll. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

New Jersey New Hire Reporting. New Jersey new hire online reporting. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey.

Get Started With ADP Payroll. Commuter Transportation Benefit Limits. New Jersey new employer rate includes.

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. New Hire Operations Center. New Jersey Sales Tax New Jersey has a single statewide sales tax rate.

NJ State Average Bronze Premium. New Jersey new employer rate. Smartassets new jersey paycheck calculator shows your hourly and.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. 03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2020. Whether its W-4 deductions gross-up or.

Worksheet for calculating household income. Enter the number of full months you resided in NJ. The new law increases the Gross Income Tax rate for income between 1 million and 5 million and provides a new withholding rate for the remainder of 2020.

Ad Process Payroll Faster Easier With ADP Payroll. PANJ Reciprocal Income Tax Agreement. As the employer you must also match your employees contributions.

The New Jersey State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 New Jersey State Tax Calculator. Get Started With ADP Payroll. New Jersey Income Tax Calculator 2021.

File and Pay Employer Payroll. 8 FREE payroll calculators for you and your employees If youre looking to calculate payroll for an employee or yourself youve come to the right place. For Social Security withhold 62 of each employees taxable wages until they have earned 147000 for the year.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What S The Most I Would Have To Repay The Irs Kff

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

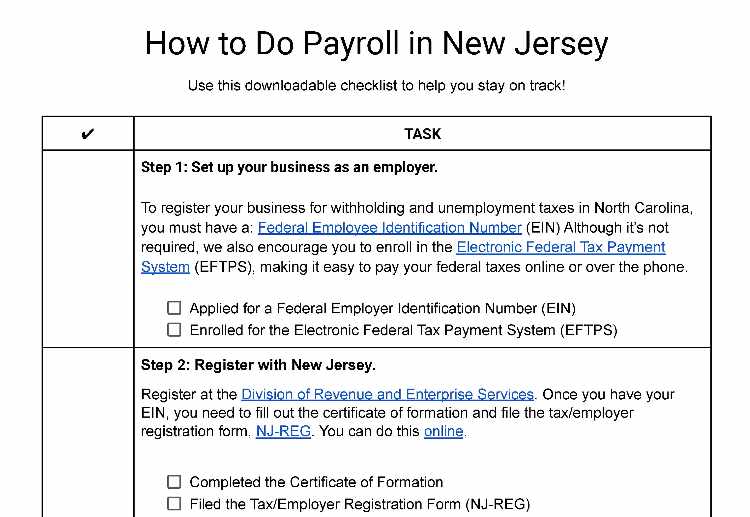

How To Do Payroll In New Jersey Everything Business Owners Need To Know

2021 New Jersey Payroll Tax Rates Abacus Payroll

New Jersey Nj Tax Rate H R Block

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planni Tax Deductions Income Tax Return Tax Refund

2022 Federal State Payroll Tax Rates For Employers

How Much Can You Contribute To A Roth 401 K For 2020 The Roth 401 K Contribution Limit Increased By 500 For 20 Tax Free Investments Roth Tax Reduction

How To Set Up Pay Payroll Tax Payments In Quickbooks

Payroll Tax What It Is How To Calculate It Bench Accounting

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)